Explore the full potential of digital assets.

Explore the full potential of digital assets.

If you plan to top up more than $100,000, a dedicated relationship manager will assist you in optimizing earnings, reducing expenditures, and increasing portfolio assets.

Grow your business through Premium Bridgers OTC borrowing, lending, and trading desk with help from a dedicated relationship manager.

in transaction volume and collateralized credit issued

jurisdictions worldwide

in interest paid

Individuals, businesses, and institutions rely on us

to help grow their digital asset portfolios.

Individuals, businesses, and institutions rely on us

to help grow their digital asset portfolios.

Signing up for a Premium Bridgers account is quick and straightforward:

New users must undergo a mandatory 24-hour cool-off period starting from the moment they complete their Identity Verification. During this period, interaction with our services is restricted, although you can complete the required assessments.

During this stage, we will ask our users to specify their investor type — sophisticated (experienced), high net worth, or restricted investor. Additionally, we will gather any necessary information to confirm their investor type, such as the proportion of their assets invested and assets they intend to invest in higher-risk products (like cryptoassets) in relation to their overall net assets. This FCA-established categorisation enables users to take more financially sound investment decisions. You need to successfully complete the Investor Categorisation to proceed with the Appropriateness Assessment. You have the opportunity to retake the Investor Categorisation until you successfully complete it.

We will ask our users to complete a set of multiple-choice questions, focused on general knowledge about crypto trading, as well as specifics on the Borrow and Earn products, to assess users’ awareness of the risks involved in cryptoassets and cryptoasset-derived products and services. Required by the FCA, this will help verify that you make informed and proportionate investment decisions. If you do not successfully complete an Appropriateness Assessment, you can retake it immediately. If you do not pass on the second attempt, you will be able to try again after 24 hours.

If you are a new client to Premium Bridgers, you may find it useful to review our step-by-step registration guide first. It will guide you through every phase of our onboarding including the Investor Categorisation and Appropriateness Assessment.

Creating a Premium Bridgers account is unavailable to clients residing in jurisdictions, in which we do not operate.

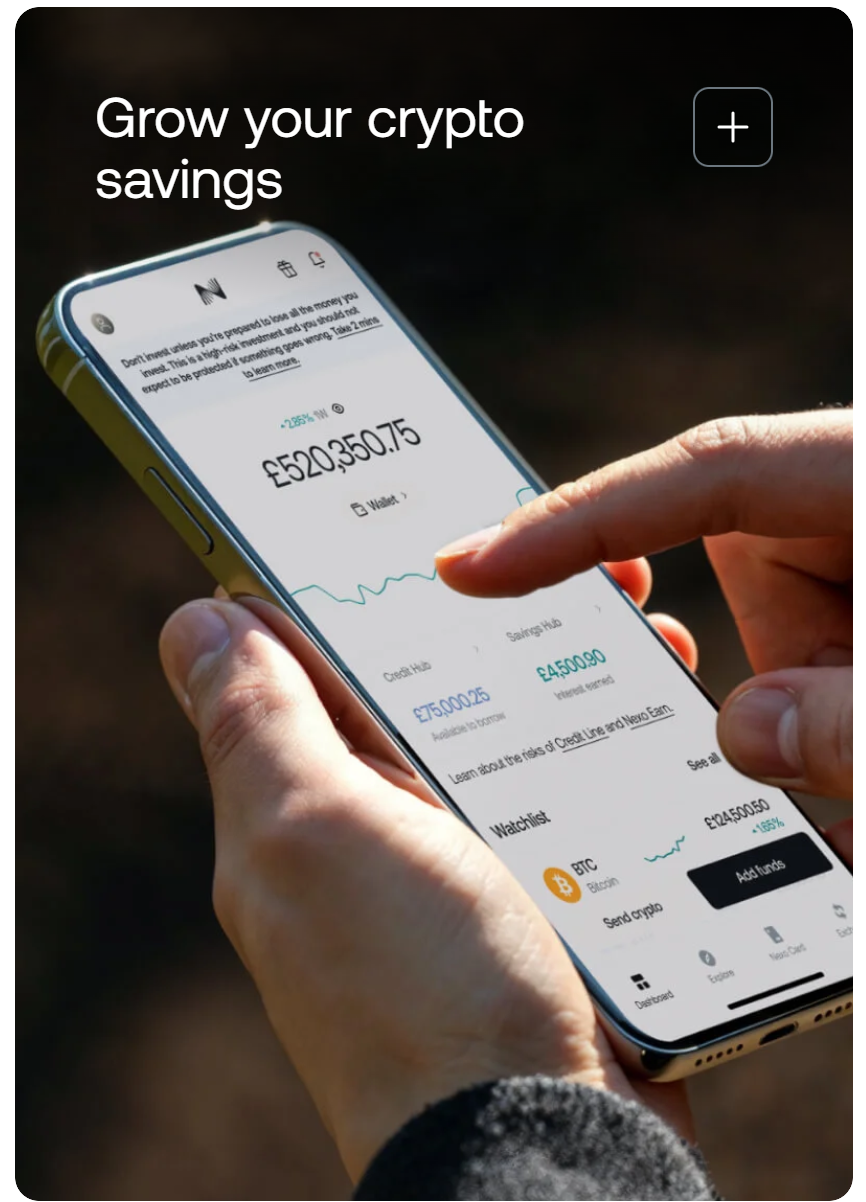

After you create your account, and complete an assessment of your general knowledge about crypto trading, you’re required to pass the Earn Assessment to verify your understanding on the specifics of the Earn product. Once completed, you only need to buy or transfer crypto to your account and you’ll automatically start earning daily interest on your digital assets with our Flexible Savings offering. Note: You’ll start earning interest the next day after your transfer. Keep in mind that, except for the Premium Bridgers Token, assets used as collateral for our Credit Lines will not earn interest.

Bitcoin, Ethereum, Solana, USDC and over 100 more cryptocurrencies are available on Premium Bridgers

To purchase any asset:

To receive a Credit Line, you need to:

1. Open the Premium Bridgers platform or the Premium Bridgers.

2. Buy or top up crypto assets.

3. Tap the ‘Borrow’ button оn the dashboard.