Access exclusive interest rates, flexible maturities, and bespoke pricing strategies via PB Private’s OTC desk.

Your dedicated relationship manager will help you explore PB Investment and use its features effectively.

Preferential PB Investment strategies help you generate passive income, whatever the market condition.

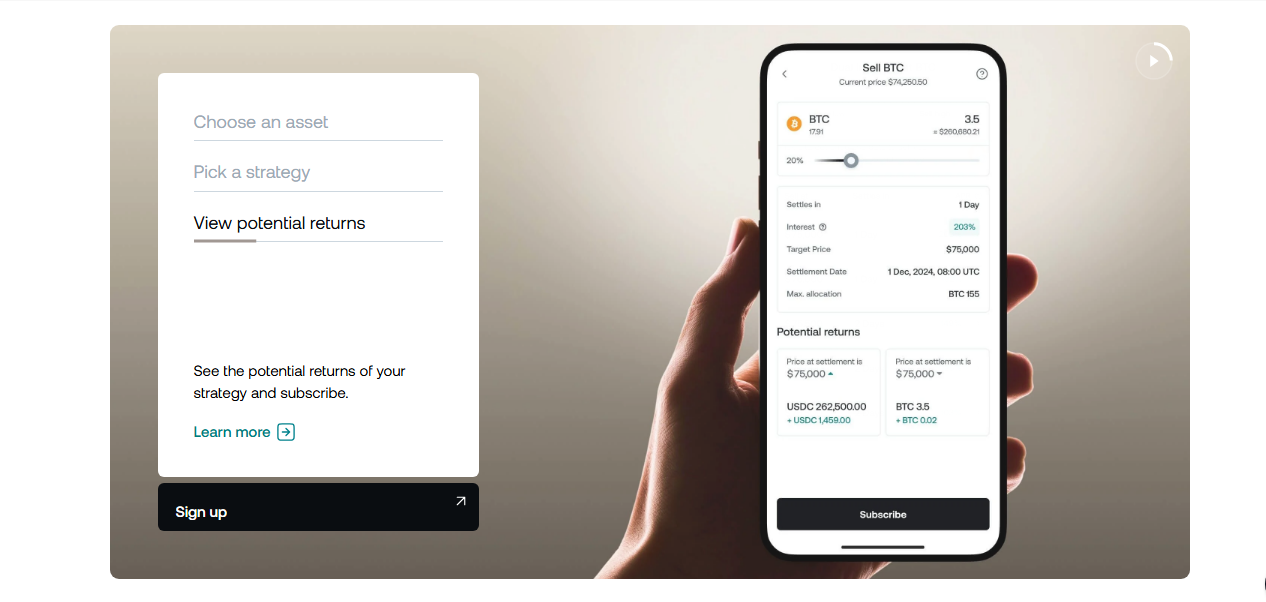

PB Investment allows you to exchange major crypto pairs at a future date if a certain price is met. While waiting for a potential exchange, you’re earning interest on your subscribed assets.

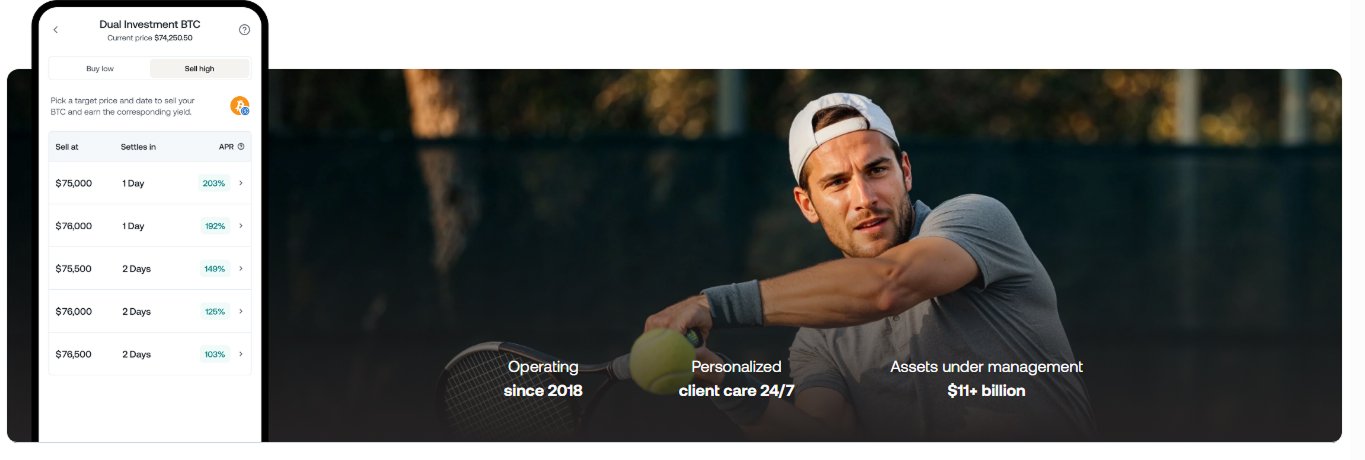

Depending on the price you’re expecting at that date, you may choose to buy low and sell high.

PB Investment includes a few key terms that you need to be aware of before subscribing to a strategy.

Target Price: The price at which you want to buy or sell your cryptocurrency.

Settlement Date: The date at which your cryptocurrency may be bought or sold.

Interest: The gain you will earn on your holdings. The interest is received in the Settlement Currency.

Subscribed Currency: The currency you will use to subscribe to PB Investment.

Settlement Currency: The currency you will receive at the Settlement Date.

To subscribe to a PB Investment strategy, you first need to complete a quiz to solidify your knowledge of PB Investment. After successfully completing it, you can then begin using PB Investment directly from your dashboard on the Premium Bridgers platform

The interest rate depends on the asset, how close is the settlement date to the moment of subscribing and the target price. Some short-dated strategies with target price close to the current price can, at times, yield triple-digit rates.

Currently, the minimum amount depends on the asset you subscribe with. The minimum for BTC is 0.01, for ETH it is 0.2, for XRP it is 1,000, and for SOL it is 10. When subscribing to a buy low strategy, the minimum amount depends on the target price.