Available to individual clients and family offices with $100,000 in digital assets, Premium Bridgers Private offers tailored onboarding, a dedicated relationship manager, high-limit OTC trading, bespoke credit, and other exclusive benefits.

The Premium Bridgers corporate account combines institutional-grade custody, advanced OTC services, and extensive 24/7 client care to help your business diversify and thrive.

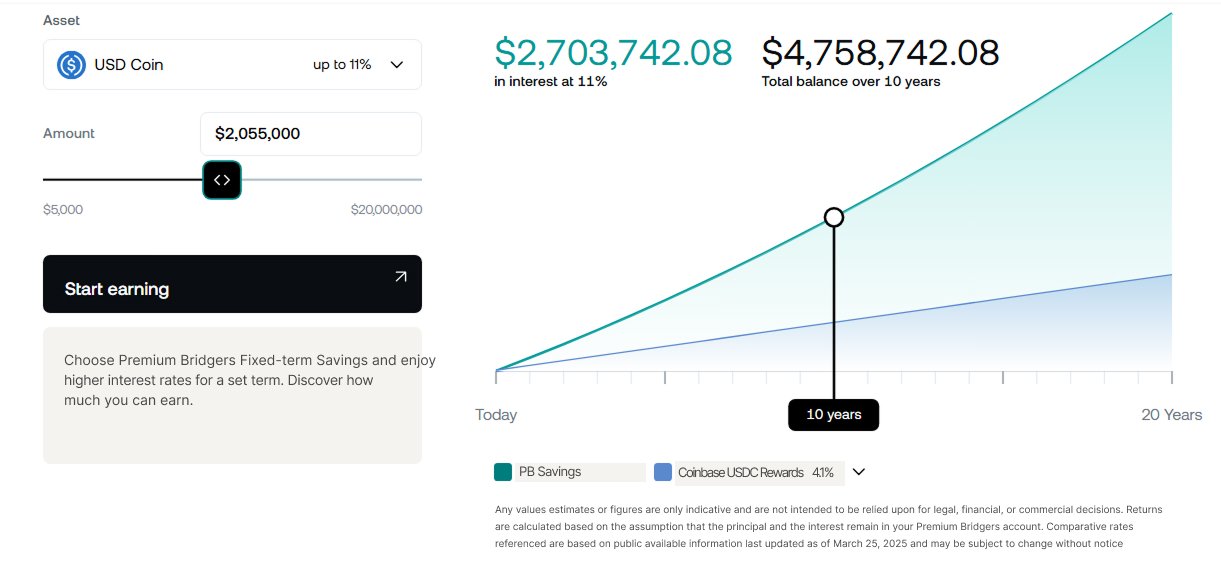

Compare your potential earnings with Premium Bridgers Flexible Savings to alternative yield options.

After you create your account, you need to buy or transfer crypto, opt in for interest earning via the Premium Bridgers app, and maintain an account balance above $5,000 worth of digital assets.

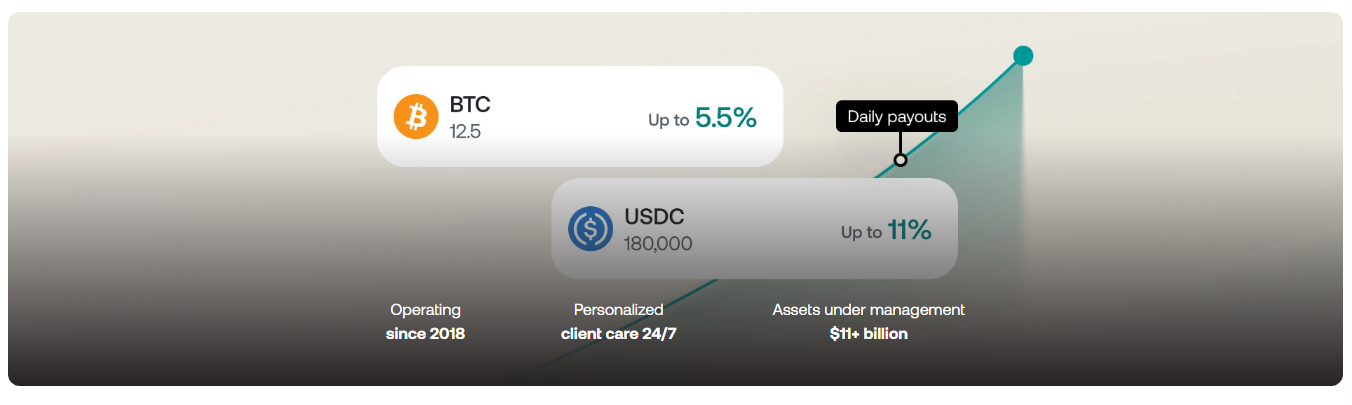

You’ll begin earning daily interest on your digital assets a minimum of 24 hours from your top-up.

Interest with Flexible Savings is paid out automatically every day to your account. The interest is credited to your Savings Wallet, where you begin earning on your holdings plus the accrued interest. This compounding effect helps you grow your portfolio faster.

To receive the highest interest, you need to:

1. Maintain an account balance above $5,000 worth of digital assets.

2. Opt in for interest earning via your Premium Bridgers account.

3. Become a Platinum Loyalty Tier client by making sure the ratio of Premium Bridgers Tokens against the rest of your portfolio is at least 10%.

4. Opt to earn your interest in Premium Bridgers Tokens for 2% additional interest.

5. Earn bonus interest for a longer period with Fixed-term Savings.

Note that a daily snapshot verifies your Loyalty Tier, which determines your current savings rate.

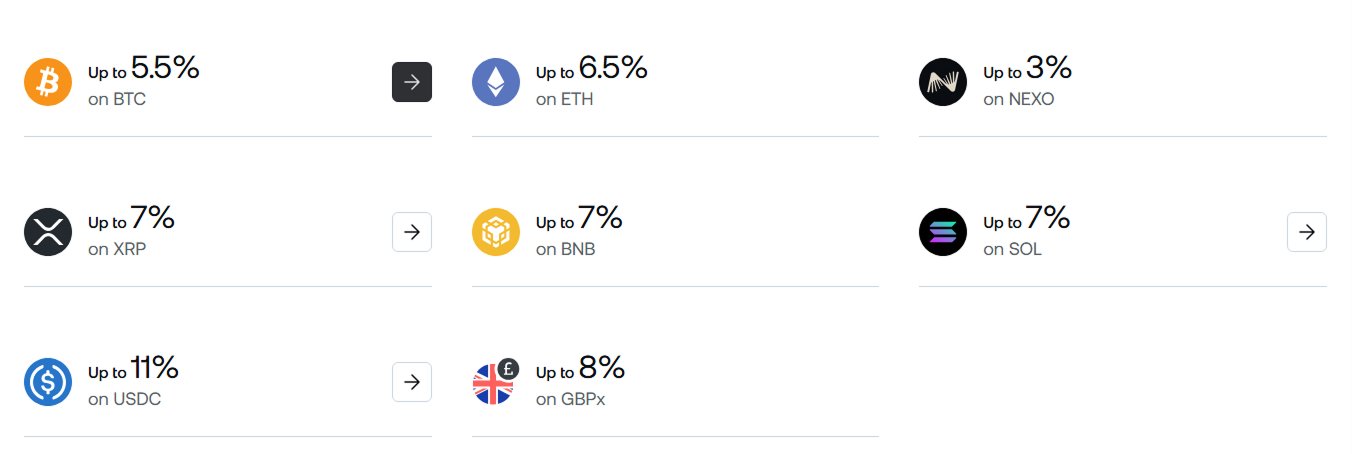

Some assets on the Premium Bridgers platform have balance limits. This means that for each Loyalty Tier for these assets there are two yields you can earn.

The rate you receive is determined by the USD value of your holdings in the relevant asset, specifically, whether you are above or below the relevant balance limit.